For instance, rent and insurance, when prepaid, become assets because the benefit will be realized in the future. Advances given to employees can be categorized as prepaid expenses only in situations where the funds are given to an employee who is expected to bear certain expenses on behalf of the company. For example, if an employee is out on an official tour, the company may give the employee money to cover travel expenses in advance. When the request was approved, she received $3,000 from her employer. Per the terms of the advance to employee contract, Emily was required to repay the loan in the next 3 months. The financial assistance Emily received from her company enabled her to purchase the car, taking advantage of specific promotional offers.

Journal Entry for Advance to Employee

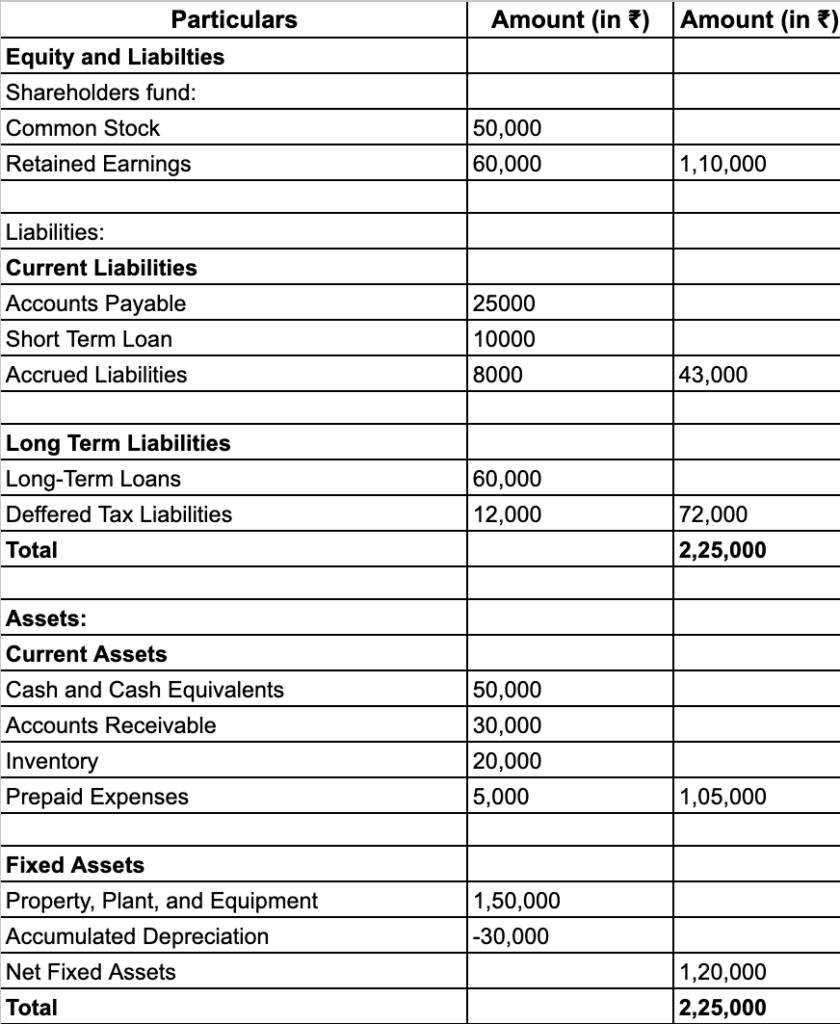

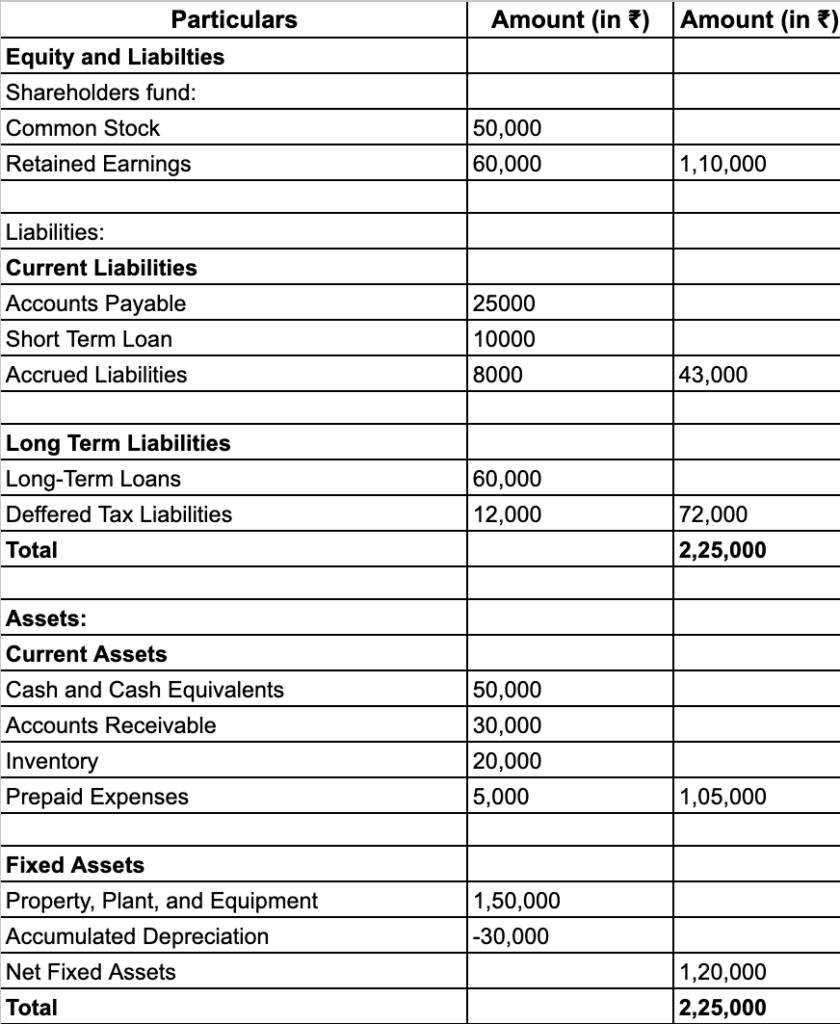

Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio. Create a payroll schedule for your employees if you haven’t previously. You can charge a fee or interest to cover your paperwork and recordkeeping responsibilities.

Payroll Advances & Repayments

Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. No, all of our programs are 100 percent online, and available to participants regardless of their location. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English.

Income Statement Under Absorption Costing? (All You Need to Know)

By doing this correctly, businesses can keep accurate financial statements and manage their cash flow. This will give you an account on your balance sheet, that will show you payroll advances and balance owed. Run your scheduled payroll with the advance payment or create an advance payment-only paycheck. If you choose to write and print a check, make sure to select the account where the advance payroll item is tracked. Then, when you create a repayment paycheck, the amount will be deducted from the account used to provide the advance.

Definition of advances to employees and officers

- It is usually cash-based and, in this case, the employee who is the borrower gets an advance payment of their earnings from the lender, which is the employer.

- If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice.

- Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

- The example below will show how to record payroll advance or salary advance to employees.

- Agree, I can’t find instructions on how to pay the advance in the first place.

If you need to loan your employees money in a pinch, you can give them an advance. Plus, Forbes magazine states that effective communication between employer and employee boosts productivity and job satisfaction. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Are payroll advances legal?

For example, an employer will see a rise in administrative paperwork and compliance with minimum wage requirements, overtime laws and the federal Truth in Lending Act. Plus, your business must be financially able to offer the employee the payroll advance, which may not be possible depending on your business’s cash flow and relationship with creditors. In such a case, the employer is required to pay payroll tax on these payments (unless the employee returns the excess payment to the employer within a reasonable time). The company will debit the current asset Advance to Employees for $800 and will credit Cash for $800.

What it does is simply increasing one asset (advance salary) and decreasing another asset (cash) at the same time. Yes, employees can request an advance payment if they are in need of funds before their regular payday. However, employers have the discretion to grant or deny such requests based on company policies or contractual agreements.

Once the request is sent to the relevant team or authority, it is reviewed and processed within a specific period. The decision-makers may approve or reject such requests at this stage. The frequency of such requests must be given due consideration while approving them to ensure employees do not exploit this facility. Employers employee advances on balance sheet may extend these loans to help staff members meet work-related travel expenses, personal emergencies, etc. Such loans may be required during payroll transitions as employees may need funds for personal expenditure until the next payday. The repayment terms are defined and communicated to the employee when the loan is given.