Posts

Although not for this reason, I have merely been operating again to your minimum wage, although I could save effortlessly, it’d getting sweet and make particular short gambling money to bolster it. You might improve your configurations any time, in addition to withdrawing the consent, by using the toggles for the Cookie Rules, or because of the hitting the newest manage consent button at the end of one’s display. Do not believe playing as a means of producing money, and just fool around with currency you could manage to eliminate. When you’re worried about the playing or impacted by people else’s playing, excite contact GamCare or GamblersAnonymous to have assist.

Balancing Profitability and you will Risk within the Martingale The forex market | casino Gaming Club

The probability of the brand new coin getting to the heads otherwise tails is actually equal while the for each flip try a different haphazard variable, therefore the previous flip does not change the second flip. Thus, if you double your bet each time you eliminate, you are going to sooner or later victory and also have all of your losses straight back and $step 1 since your funds. The newest Martingale means, to begin with available for game having equal earn/losses odds, could be high-risk from the stock-exchange. Long-merely software that have wide industry directory ETFs is recommended to have smaller risk.

Subscribe our 100 percent free publication for everyday crypto condition!

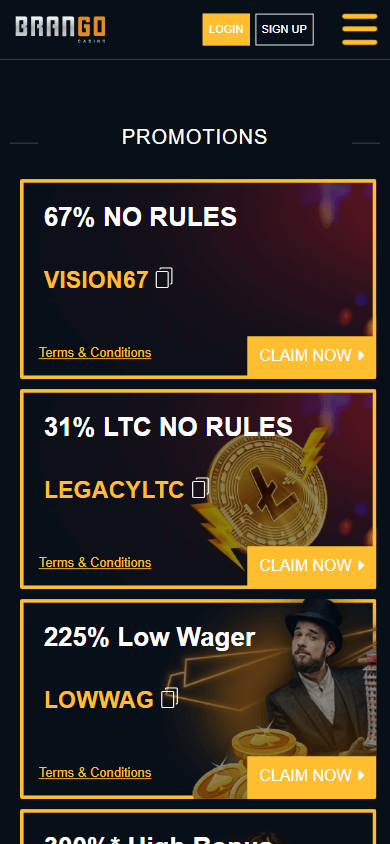

Although not, should your opportunity provided by an excellent sportsbook wear’t line-up to your Sagarin get, there is worth inside betting to the underrated party. The online is absolutely filled with dodgy online casinos, all of them provide grand bonuses always as they’re also impractical to money in. For those who’re playing on the web stick to the brand new credible labels – here’s all of our favourites, are common professional and casino Gaming Club dependable. You’ll explain exactly how confidential this article is, the way it provides the the answer to a nice little income if your proceed with the extremely secret, special gaming projects inside the Martingale. And also alert your readers, getting cautious as the gambling enterprises will want to prohibit you, think about don’t build money too soon so you can arouse suspicions. Whilst the martingale method may seem simple and easy novel, this isn’t for all.

The brand new Martingale method requires increasing the status proportions by doubling they after every loss, and therefore demands a good number of funding. People who do not practice best investment management can simply sustain losses. To avoid it error, you ought to place an optimum losings restrict for every change and you can be sure to don’t accept much more risk than just it limit. The new Anti-Martingale program, as the name implies, is the reverse of your Martingale approach. Within system, people lose their reputation models when they lose while increasing her or him after they winnings. Put differently, when an investor feel a loss of profits, they unlock shorter ranks within the next trade, and if they win, they focus on increasing the ranking to optimize winnings.

- But not, if the notes are generating a losing streak for you, it may get expensive immediately.

- Naturally, you believe you to 6 thoughts in a row is quite unlikely, so the second flip has a greater chance of landing to the tails.

- But not, the methods’s aggressive nature requires ample investment and energetic risk government to help you avoid devastating loss.

- This method is similar to just how bettors double its wagers immediately after for each loss, that is not surprising that since the means develop on the playing world.

- It’s always employed for wagers one pay twice your own share if your winnings, such as gambling for the red-colored or black colored inside roulette, or sporting events wagers during the evens (dos.0 chance).

Great things about Martingale Trading

Knowing the intricacies of the Martingale strategy is critical for one investor offered the fool around with. Awareness of both the potential advantages and you will built-in threats is needed because of it competitive position sizing program. The fresh Martingale strategy carries risks, along with exponential reputation sizing, extended trend, and you will psychological worry. People will be pertain risk government processes and you will evaluate industry standards so you can mitigate such dangers. There are several disadvantages with all the Martingale trade strategy. First, since the approach can perhaps work inside theoretical terms, the fact is that loss can also be install.

Martingale Trading Strategy inside Fx

The brand new appeal of your Martingale program will be based upon the seeming ease; although not, it takes a big money and you may nerves from material, especially during the a lengthy dropping streak. Of many people utilize this strategy, believing that they’re able to avoid long losing streaks, but also top-notch investors features losing lines, so money administration can be so crucial. Martingale has its sources in the wonderful world of gaming, that makes to have an incredibly high-risk change approach.

For individuals who be the cause of the last $ten and you will $20 losings, you would’ve attained an online cash away from $ten of all the investments you made. Suppose an investor begins with a predetermined trade sized $50 and succeeds with their first exchange. Once they allow it to be once more, the brand new trade size might possibly be twofold to $200, and so on. Here is how the new Martingale means applies for the currencies field.

Reverse Martingale, labeled as the new Paroli system, is a gambling approach where people increase their wagers after a victory and drop off its bets just after a loss. Here is the opposite of the Martingale program, where people enhance their bets once a loss of profits. For example, for many who begin by a good $ten bet and winnings, then you improve your wager to help you $20 to your 2nd round. No roulette strategy can also be ensure an earn, and the Martingale technique is no exception.

We all know that the £10,240 spin features an extremely high bad EV and you will isn’t worth doing. But not, since the loss increase, thus really does the newest enticement in order to choice ever increasing amounts to pay for such loss. That have a good £1 carrying out risk, your own losses of a losing move from ten will be £1023. Having a great £1 undertaking risk, their losings of a losing streak away from 9 would be £511. With a good £step 1 carrying out stake, the losses from a burning streak of 8 was £255. With an excellent £step 1 doing stake, their losses of a losing streak of 7 might possibly be £127.

Using the Martingale Means inside the Crypto

Just before with their any wagering means, be sure to know the beliefs, as well as the dangers and advantages. This strategy aims to limit the quantity of losses to own a good selection of wagers. It’s a slow, much more conventional method than the Martingale, however it nonetheless keeps the same exposure – a burning move you are going to rapidly fatigue your money.

The notion of an excellent Martingale Change Strategy isn’t an investing logic but a mathematical one. It is produced from the concept that you will eventually getting best when turning a money if you undertake thoughts more than and you can more than. In this post, we are going to security the fresh Martingale Means, that’s my favorite means to fix change but is very dangerous. Please keep in mind that if you would like try this Fx approach, you are risking a lot.

The new Martingale betting system was developed so you can wager on consequences you to has a great 50/50 risk of density, like the flip away from a money. Nevertheless could have been modified for usage from the online casino games out of blackjack and you will roulette. For example, for those who already been having $step one and you will lost, the next wager will be $2. If it in addition to causes a loss, the following bet was $cuatro, and stuff like that, up to a profitable exchange takes place. Growing wagers allows you to defense the prior losings and you can obtain a small profit. Whenever applied truthfully, especially in a market which have a higher probability of winning than dropping, the newest Martingale approach can be yield nice production within the crypto trade.