This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts.

How to avoid a sales tax audit

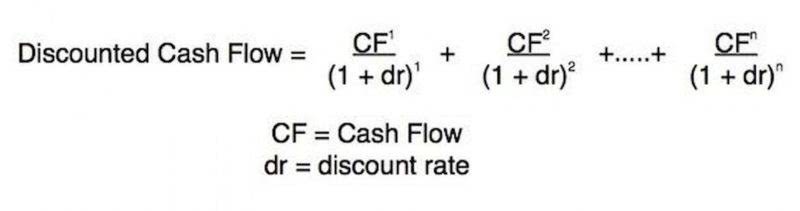

With each of these figures, you can use a sales tax calculator to do the math for you, right down to the last decimal. Knowing how to calculate sales tax is important, especially if you’re saving up for a large purchase. To calculate sales tax, multiply the total cost of the product by the sales tax rate levied in your area. When selling online, businesses may still need to charge sales tax, also known as internet sales tax.

Bankrate logo

If you sell products to customers who turn around and sell the same product to customers, you might not need to collect sales tax. Instead, your customer, who becomes the seller, must collect sales tax. The customers must have resale certificates to be exempt from paying sales taxes. When selling online, you first need to determine if you are required to collect sales tax from buyers in your buyer’s state.

What products and services require sales tax?

You then must remit the sales tax to the proper state or local tax agency. In 1979, the Tax Foundation published a study giving some insight into the arguments for or against VAT versus sales tax. It contained information about some of the advantages of taxation with VAT. Taxes like VAT can raise more money than sales taxes at a given rate. Tax evasion is more difficult with VAT because this tax is applied at every stage of a good’s production cycle.

State-by-state sales tax rates

Since higher savings contribute to higher investment, relying more on consumption tax may favor a higher rate of economic growth. In both types of taxes, the tax burden is charged on the final consumer; https://www.bookstime.com/ however, they have a different framework of collection, administration, and effects on the economy. Through a simple example, the below table illustrates the comparison between VAT and retail sales tax.

Business sizes

What is nexus?

- In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time.

- If you’re working with a developer, they can take advantage of the AvaTax API to build sales tax rate determination into your application.

- Additionally, 38 states allow local governments to collect sales taxes.

- In the United States, sales tax is calculated as a percentage of the retail price of certain goods or services.

- All participants in the supply chain (such as wholesalers, suppliers, and manufacturers) must pay VAT, not just the last buyer, as is the case with sales tax in the United States.

- To calculate sales tax, multiply the total cost of the product by the sales tax rate levied in your area.

- A calculator takes into account the various tax rates applicable to specific locations and eliminates the risk of errors.

- Property taxes are a major source of income for city and county governments.

- The Small Business Administration offers a breakdown of sales tax permit requirements by state.

- It’s categorized as a consumption tax because sales taxes are generally passed along to consumers at the point of sale.

- It’s important to check the specific rules and regulations in your jurisdiction as the items subject to sales tax can vary.

- Check your payment balance, file a return, make a payment, or respond to a department notice—anywhere, anytime.